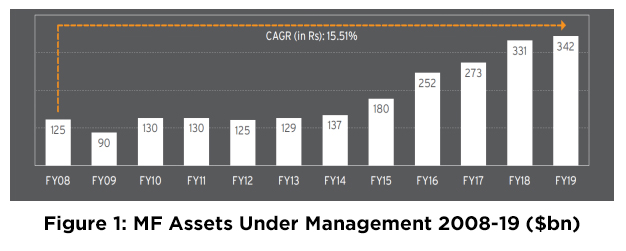

If we are looking at some of the financial sectors in India that have shown substantial growth in the last decade, then Mutual Funds (MFs) would surely be one of them. The sector has seen a lot of new Mutual Fund providers, schemes as well as new investors. As of December 2020, there are 44 Mutual Fund houses offering more than 2,500 schemes.

Source: India 2019, Mutual Funds Report, CITI Bank

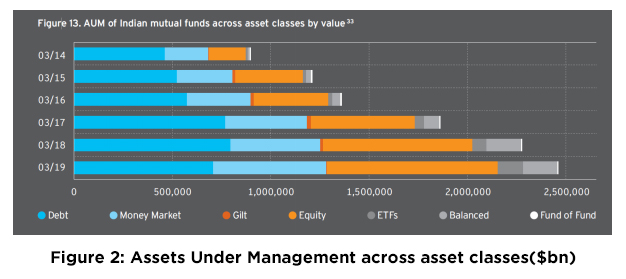

Source: India 2019, Mutual Funds Report, CITI Bank

MFs are basically pooled investments wherein an intermediary (typically an Asset Management Company) collects funds from investors and invests them in a particular type of securities. Every Mutual Fund scheme has a well-specified approach and methodology of investing.

For those investors who want to create a diversified investment portfolio and do not have the time or resources to manage it, MFs offer a ready-made solution. MFs are professionally managed, follow a systematic approach, provide liquidity and are well-regulated by SEBI. In spite of all these advantages, there are a few shortcomings of investing in MFS, in the form of lack of customisation, confusing terminologies and at times, choice overboard.

It can be a daunting task for a new Investor trying to invest in a MF Scheme, as the terminologies and technicalities can be a bit overwhelming at times. Hence, it is better to have a basic understanding on different types of MF schemes and some of the parameters which are critical in selection of MF schemes. Considering this, even business schools and management education institutes are focusing on MF as a separate area of study and a potential employment opportunity.

i. Open Ended: Open for investment/redemption throughout the year

ii. Close Ended: Open for investment/redemption only during specific period

i. Equity: Invest in Equity shares from Large Cap, Mid Cap, Small Cap categories as well as some other type of schemes can be ELSS, Multi-cap, Sector-wise,Thematic, Contra funds, Arbitrage funds, Focused funds etc.

ii. Debt: Invest in Debt instruments from Government (Gilt), Corporates (Long term and short term)

iii. Money Market: Invest in Liquid and Ultra Short-Term securities

iv. Commodities: Invest in Commodities though majority of them invest in gold

v. Index: Replicate a particularstock market Indexlike Nifty, Sensex etc.

Fund of Funds: Invest in other Mutual Fund schemes

A MF investor should go through all the parameters listed below before finalising on a particular MF scheme.

Prof. Siddhesh Soman

Assistant Professor,

DR VN BRIMS, Thane.

Also read : MANAGEMENT PARADOXES

VN Brims college Thane is One Of The Best Management college in Thane Mumbai We Provide Programs & Courses Like MMS, PGDM, Value Added Courses, MDP Etc.SS

Talk To Us On (+91) 2536 4492 / 2544 6554 Or Email Us At vnbrims@vpmthane.org

Happy To Help!

Read More About MBA College Thane Blog

Share This: